USDA’s Direct Home Loan Program

- USDA Direct Housing Loans are less common than USDA Loan Guarantee Program loans and are only available for low and very low income households to obtain home ownership, as defined by the USDA. Very low income is defined as below 50 percent of the area median income (AMI); low income is between 50 and 80 percent of AMI; moderate income is 80 to 100 percent of AMI. For these types of Rural Housing Loans, a borrower must contact the local USDA office directly.

502 Direct USDA Loan in Kentucky:

There are two types of Kentucky USDA Rural Housing Home loans available to rural Kentucky Home buyers through Rural Development:

Direct homeownership loans and guaranteed home ownership loans.

Let’s first look at the 502 Direct USDA Loan in Kentucky

502 Direct USDA Loan in Kentucky:

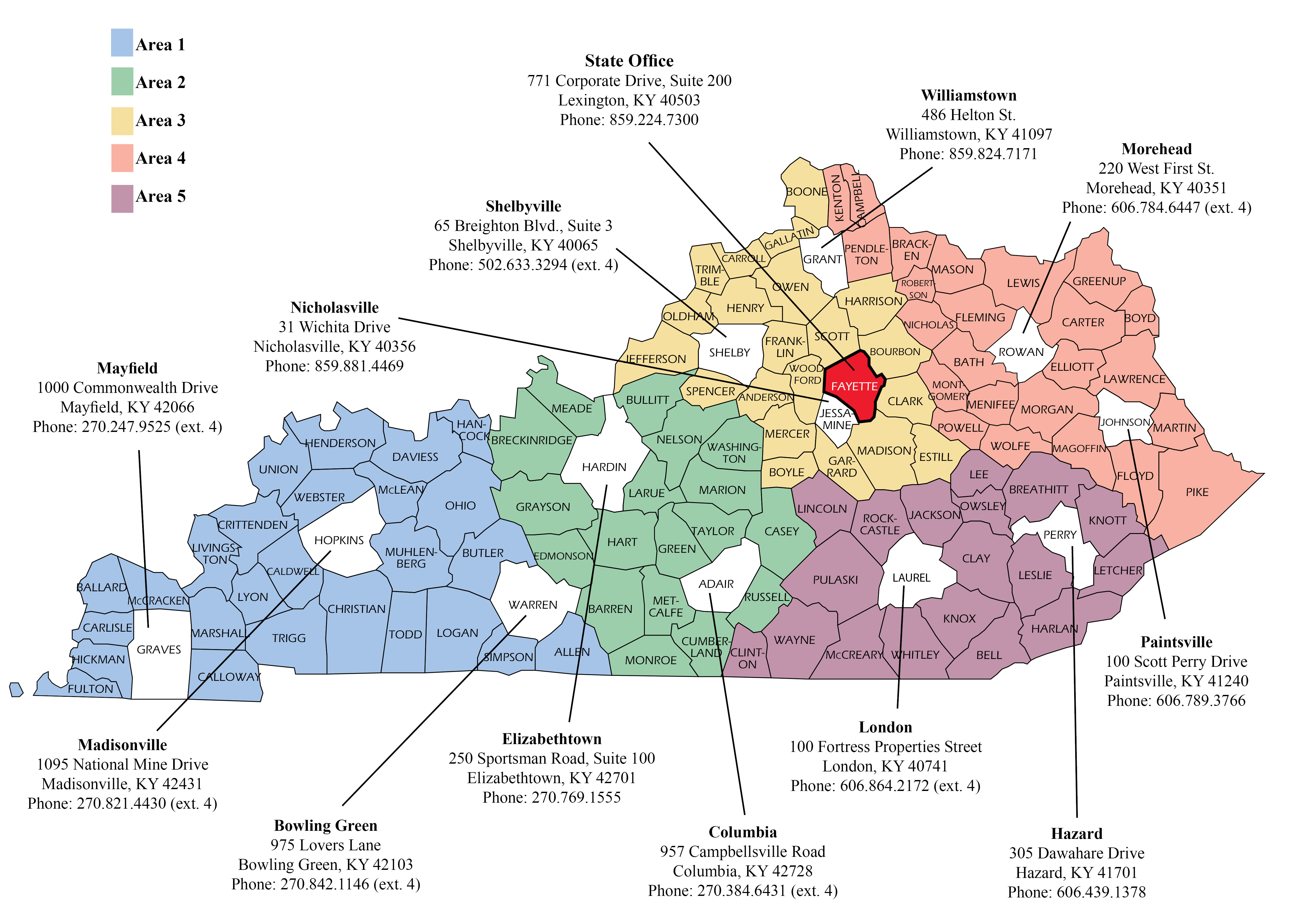

With a Kentucky Direct Loan 502, the applicant applies directly to the USDA office serving their location in Kentucky. There are about 13 different locations . They lend the money direct from USDA , 100 percent financing, for the low rate currently at 3 percent on a 33 year term.

For a direct home loan, the purchase, construction, repair and rehabilitation of a single family home in rural areas must be used for the applicant’s permanent residence. “For manufactured housing, only new construction can be funded,” he explained.

Credit scores of 640 or greater are typically acceptable with a minimum number of trade lines (2 usually for 12 months can be opened or closed) that have been open and active.

No down payment typically is required- Loans may be up to 100 percent of the appraised value. Homebuyer education is required prior to closing for the Direct USDA Loan 502 program