Job History and Income Requirements Kentucky Government Mortgage FHA, VA, USDA and Fannie Mae Mortgage Home Loan Job History

Kentucky Government Mortgage FHA, VA, USDA and Fannie MaeMortgage Home Loan Job History & Income Requirement Breakdown    |

|---|

I specialize in Kentucky USDA Rural Housing mortgage loans in KY. Apply for free today for a Rural Housing loan Pre-Approval Letter. Same day approvals. I offer the USDA Rural Development Guaranteed Housing Loans for all counties in Kentucky that are eligible. Put my expert advice to use. Call or text 502-905-3708 or email kentuckyloan@gmail.com This website is not affiliated with USDA or any other government agency. NMLS# 57916 NMLS# 1738461

Kentucky Government Mortgage FHA, VA, USDA and Fannie MaeMortgage Home Loan Job History & Income Requirement Breakdown    |

|---|

| Income Type | Income - Eligibility | Income -Qualifying |

|---|---|---|

| Household Income in Kentucky |

Income of all adult members of the household are considered for qualifying purposes even if they are not on the loan application

|

Use only income from borrower(s) on the loan application

|

| W-2 Annual Income in Kentucky |

Use Box 3 – Social Security Income

|

Use Box 1 – Wages, tips, other comp

|

| Court Ordered Child Support and Alimony | Use court ordered amount even if not receiving income regularly. This is for all members of the household | Must document on-time receipt over the previous 12 months |

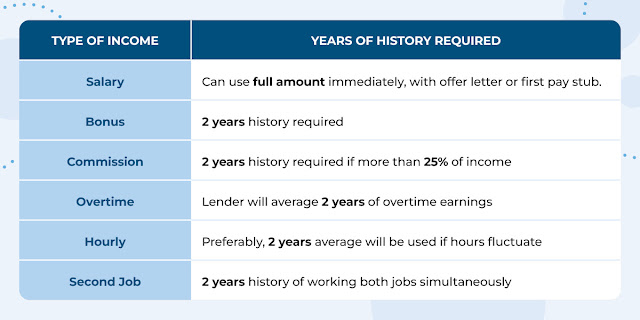

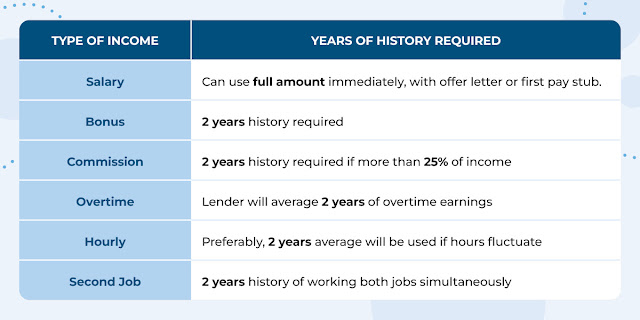

| Part-Time, Overtime, and Bonus Income | Any income earned is extrapolated over a 12 month period of time | Need a two year documentable history with the same employer to be considered |

| Business Income/Loss | Business income or loss from a previously filed tax return will be used to determine income | Need a two year documentable history provided by tax return information obtained directly from the IRS |

| Unemployment Income | Benefit received from current year (and possibly previous year even if non-reoccurring) will be added to income eligibility | Only unemployment income derived from seasonal planned layoffs will be considered as qualifying income. All other unemployment income will be disregarded |

| Unreimbursed Business Expense | Reduce income eligibility income | Reduce income qualifying income |