Kentucky Government Mortgage FHA, VA, USDA and Fannie MaeMortgage Home Loan Job History & Income Requirement Breakdown    |

|---|

I specialize in Kentucky USDA Rural Housing mortgage loans in KY. Apply for free today for a Rural Housing loan Pre-Approval Letter. Same day approvals. I offer the USDA Rural Development Guaranteed Housing Loans for all counties in Kentucky that are eligible. Put my expert advice to use. Call or text 502-905-3708 or email kentuckyloan@gmail.com This website is not affiliated with USDA or any other government agency. NMLS# 57916 NMLS# 1738461

Pages

- How to Apply for a Kentucky USDA Rural Development Mortgage Loan Approval

- Kentucky USDA and Rural Housing Credit Scores Guidelines

- KENTUCKY USDA RURAL HOUSING ELIGIBILITY MAP FOR 2025

- Kentucky USDA Rural Housing income Limits 2025

- Kentucky RHS USDA Guaranteed Loan Income Worksheet

- Eligible Properties for KY USDA Rural Development loans

- Kentucky Offices Kentucky Rural Development Offices

- Home

- Privacy, Legal and Licensing Information

- About Me and this Website

- Home

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Job History and Income Requirements for a Kentucky...

How much money do I have to make to qualify for a Kentucky Rural Housing Loan?

|

|

Kentucky Rural Housing USDA's Income Requirements for Mortgage Approval

USDA Loans require that the borrower's income meet both "Income Eligibility" and "Income Qualifying" requirements.

Income Eligibility is income used to determine whether the income of all adult household members exceeds USDA's county specific and household size allowable limit. Income Qualifying is the income used to determine whether the income is appropriate to support the loan request. The components used to determine the income for both criteria differ.

A common list of areas that should be reviewed by the Loan Officer with the borrower is as follows:

| Income Type | Income - Eligibility | Income - Qualifying |

|---|---|---|

| Household Income | Income of all adult members of the household are considered for qualifying purposes even if they are not on the loan application | Use only income from borrower(s) on the loan application |

| W-2 Annual Income | Use Box 3 – Social Security Income | Use Box 1 – Wages, tips, other comp |

| Court Ordered Child Support and Alimony | Use court ordered amount even if not receiving income regularly. This is for all members of the household | Must document on-time receipt over the previous 12 months |

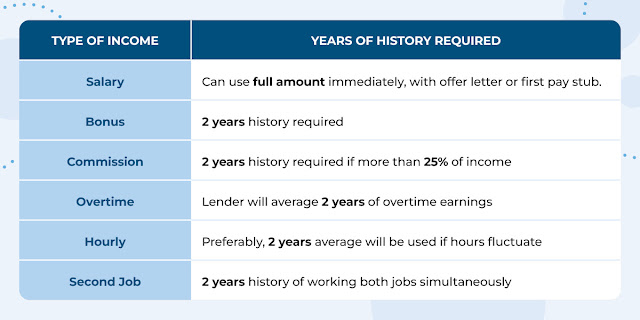

| Part-Time, Overtime, and Bonus Income | Any income earned is extrapolated over a 12-month period of time | Need a one-year documentable history with the same employer to be considered |

| Business Income/Loss | Business income or loss from a previously filed tax return will be used to determine income | Need a two-year documentable history provided by tax return information obtained directly from the IRS |

| Unemployment Income | Benefit received from current year (and possibly previous year even if non-reoccurring) will be added to income eligibility | Only unemployment income derived from seasonal planned layoffs will be considered as qualifying income. All other unemployment income will be disregarded |

| Unreimbursed Business Expense | Reduce income eligibility income | Reduce income qualifying income |

Employment job history requirements for a USDA Loan Approval In Kentucky

Kentucky USDA Mortgage Program

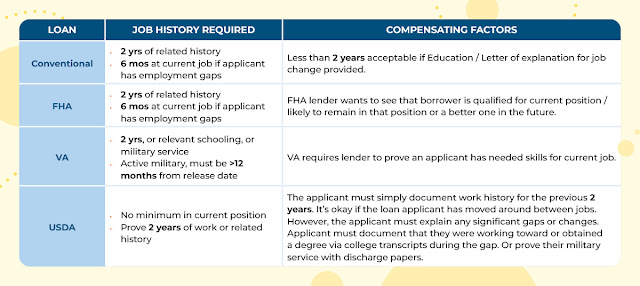

The USDA Home Loan Program does not technically have an minimum employment history requirement but lenders are required to verify applicants' employment history for the prior two years and confirm that the applicant's income is stable

Applicants are required to explain any employment gaps of at least one month

Explainable employment gaps of six months or more are also permitted as long as the applicant can document the reason for the gap, has been back to work for at least six months and has a two year employment history prior to the work gap

Self-employed borrowers are typically required to demonstrate a two year job history as documented by the applicant's tax returns

A self-employed job history of between one and two years is permitted if the applicant was previously employed in a similar line of work for at least two years or one year of work plus one year of formal education or training

The lender is required to confirm that the self-employment income is expected to continue for at least three years

A self-employed history of less than one year is not permitted

An uninterrupted two year history in the same position is typically required for part-time employment although a part-time work history of less than two years may be considered if the lender verifies with the employer that the work is likely to continue at the same compensation level

Income from seasonal employment is permitted as long as the applicant has a two year work history and expects to be rehired for future seasons

The lender is required to determine that part-time and seasonal income is expected to continue for the next three years

Income from part-time or seasonal work must be reported on the borrower's tax returns to be considered by a lender

A consecutive two year payment history and determination by the lender that the income is expected to continue for the next three years is required for bonus, commission or overtime income to be considered

Bonus, commission or overtime income earned for less than a year is not permitted without significant compensating factors such as a change in the applicant's compensation structure

Lenders are required to explain any significant declines in bonus, commission or overtime income

Significant variations in bonus, commission or overtime income may require the lender to use an average period of more than two years to calculate the applicant's income

Kentucky Rural Housing USDA Income Eligibility guidelines.

USDA Loans in Kentucky equire that the borrower's income meet both "Income Eligibility" and "Income Qualifying" requirements. Income Eligibility is income used to determine whether the income of all adult household members exceeds USDA's county specific and household size allowable limit. Income Qualifying is the income used to determine whether the income is appropriate to support the loan request. The components used to determine the income for both criteria differ.

A common list of areas that should be reviewed by the Loan Officer with the borrower is as follows:

| Income Type | Income - Eligibility | Income -Qualifying |

|---|---|---|

| Household Income in Kentucky |

Income of all adult members of the household are considered for qualifying purposes even if they are not on the loan application

|

Use only income from borrower(s) on the loan application

|

| W-2 Annual Income in Kentucky |

Use Box 3 – Social Security Income

|

Use Box 1 – Wages, tips, other comp

|

| Court Ordered Child Support and Alimony | Use court ordered amount even if not receiving income regularly. This is for all members of the household | Must document on-time receipt over the previous 12 months |

| Part-Time, Overtime, and Bonus Income | Any income earned is extrapolated over a 12 month period of time | Need a two year documentable history with the same employer to be considered |

| Business Income/Loss | Business income or loss from a previously filed tax return will be used to determine income | Need a two year documentable history provided by tax return information obtained directly from the IRS |

| Unemployment Income | Benefit received from current year (and possibly previous year even if non-reoccurring) will be added to income eligibility | Only unemployment income derived from seasonal planned layoffs will be considered as qualifying income. All other unemployment income will be disregarded |

| Unreimbursed Business Expense | Reduce income eligibility income | Reduce income qualifying income |

Senior Loan Officer

(NMLS#57916

text or call my phone: (502) 905-3708

email me at kentuckyloan@gmail.com

What are the income and employment guidelines for a Kentucky Rural Development Loan Housing Approval?

There is no minimum length of time an applicant must have held a position to

consider employment income as dependable.

Lender must verify the applicant’s employment for the most recent 2 full years

& verify that the applicant’s income has been stable.

The applicant should not have any gaps in employment of more than a month

within the 2 year period prior to making the loan application.

Applicants that have not been employed for 12 months with their current

employer or have experienced a significant earnings increase are considered high

risk.

• Second jobs, full 2 year history

• Unearned income, 3 year continuance

• Self‐employed applicants, 2 year history

Newly Employed:

Less than a 2-year employment & income history can be considered when documentation = applicant was attending school immediately prior to current employment.

School Program/Classes must correlate to job!

For those applicants about to start a new job:

Firm offer letter from new employer indicating the job will begin within 60 days of loan closing

Re-entering the Workforce:

Applicants who re-enter the workforce after an absence to care for a family member or minor child,

extended medical illness, or other reasonable circumstances & less than 2-year employment &income history: May be considered for repayment income if the applicant has been at the current employer for a minimum of six months and there is evidence of a previous employment history

Significant increases or decreases in income level:

Experienced a Significant Decrease?

Previous higher income cannot be averaged for repayment purposes

unless there is documentation of a one-time occurrence (e.g. injury)

that prevented working or earning full income for a period of time & proof that the applicant

is back to the income amount that they previously earned. Focus on the most recent earnings

and income that is likely to be received at the level used for qualifying.

Experienced a Significant Increase?

Proposing to qualify the applicant at the higher amount?

NEED: sufficient documentation to confirm the increased income is stable and likely to

continue at the level used as part of the written analysis

Fixed Income like Social Security, SSI, non-taxable income:

• May be grossed up 25% for repayment

• Do not gross up for annual income

• No other adjustments are authorized

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the views of my employer. Not all products or services mentioned on this site may fit all people