Kentucky Rural Housing Loans

Eligibility for Kentucky USDA Loans

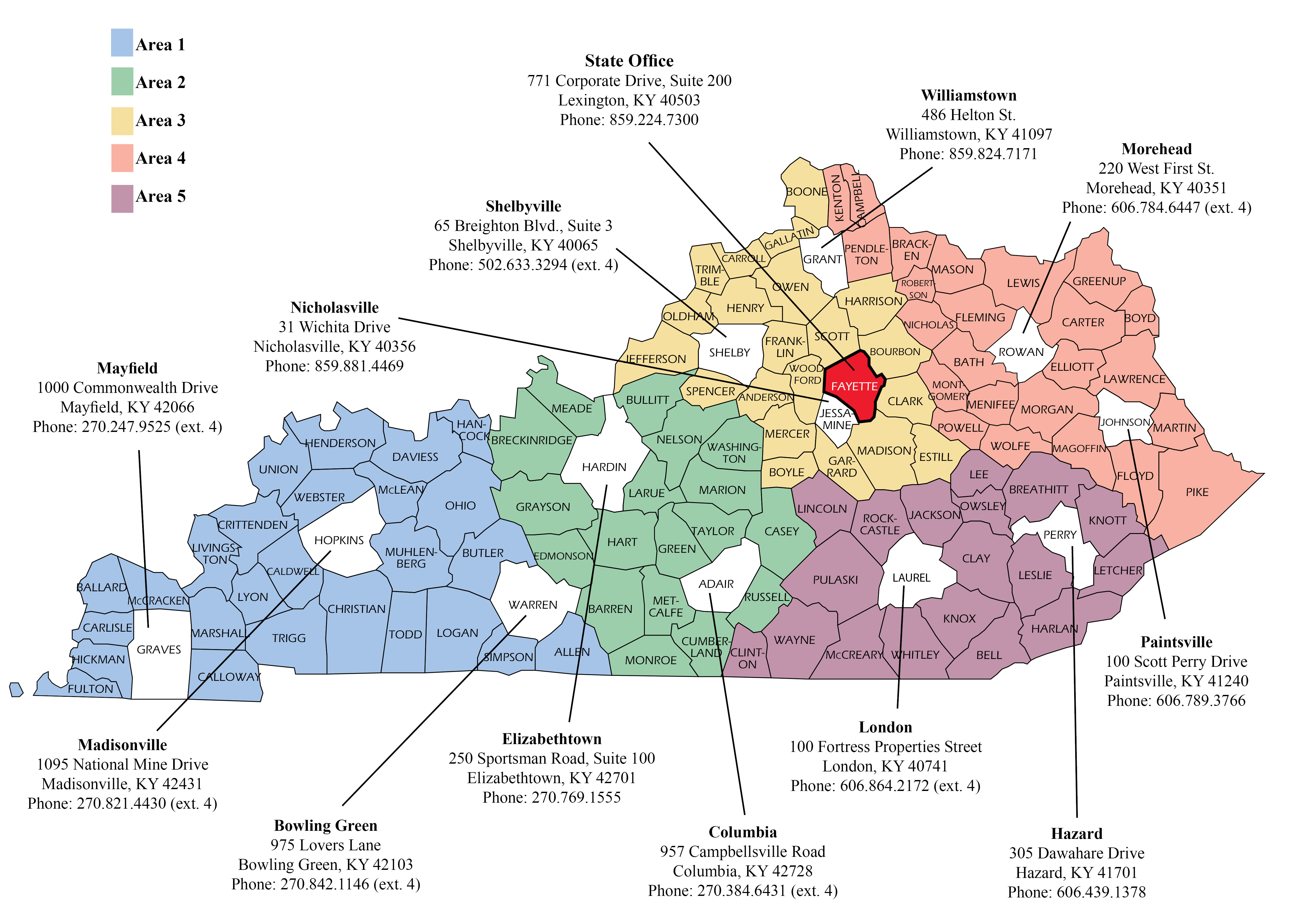

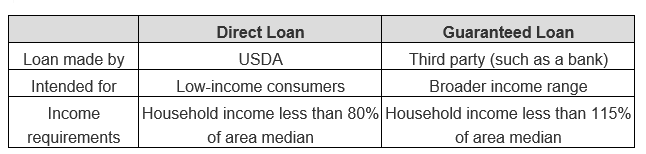

- Loan income restrictions see map ⬇️

- Credit score You have three credit scores, they throw and the high and low score and take the middle score of each of the three main credit bureaus, Experian, Equifax, and Transunion. Most lenders will want a 620 middle credit score due to the fact that GUS (Guaranteed Underwriting System) will not give you an automated approval upfront if the middle score is below the 640 thresholds. You may get a refer eligible on the initial pre-approval but a lot of lenders will not honor a refer eligible USDA file. On paper USDA says they will go down to a minimum credit score of 581 but most lenders will not touch them.

- Property Ownership (Do you own other Property) In most cases, USDA will not allow you to use their program to purchase another home if you already have a home in your name. In some extreme cases, they will waive this if certain exceptions are met. You can call or email me for more details on this matter. The USDA loans are only available for single family primary residences. No rental homes or working farms are allowed on the USDA Home Loan Program

- Residential Location (USDA Eligibility: to check click here ) Is the property located in a Eligible area. See link above for eligibility boundaries for counties in Kentucky

- Debt to Income Ratios: If your credit score is above 640, GUS will typically limit your back-end ratio to 45% of your total gross income. The front end ratio, or the housing ratio, usually is centered around 30% to 35% range, with compensating factors such as assets or money in bank to cover your new house payment, disposable income, high credit scores, and no rent payment shock. Rent payment shock is where your new house payment is much larger than your current rent payment. This only comes into play on lower credit scores.

- Assets I have noticed that with 3 or 4 months reserves you can typically get a loan approved with lower credit scores with payment shock on the new loan. Additionally, if you have access to 20% down payment in your checking or savings account, they will make you use your own money. If the money is in a 401k or other tax deferred savings accounts this will not factor in and you can use the USDA loan program.

- I can explain this more in detail if you want to call or email me.

https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do

Look-up tool to determine maximum household income limits for a Kentucky County

👇

http://eligibility.sc.egov.usda.gov

Joel Lobb Mortgage Loan Officer

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

NMLS ID# 57916,