USDA Loans Kentucky: Get Approved with a 580 Credit Score in 2025

Think a 580 credit score means you can’t buy a home in Kentucky? You have a path. USDA Rural Housing offers zero down payment financing with competitive rates, and manual underwriting provides flexibility for qualified borrowers at 580 and above.

Quick facts

- Minimum score: 580 via manual underwriting

- Down payment: 0% (finance 100% of purchase price)

- Counties: Eligible areas exist in all 120 Kentucky counties

- Typical timeline: 30–45 days (manual underwrite can add time)

What USDA loans are and how they work in Kentucky

USDA Guaranteed loans are issued by approved lenders and backed by the U.S. Department of Agriculture to promote homeownership in rural and many suburban areas. Kentucky’s broad rural footprint makes this program a strong fit for buyers across the Commonwealth.

Two channels exist: USDA Direct (for very low-income borrowers) and USDA Guaranteed (most common). Most Kentucky buyers use the Guaranteed option for broader eligibility and lender choice.

Tooling: verify addresses on the USDA eligibility map and confirm household income limits before you shop.

580 credit score approvals via manual underwriting

Automated findings often prefer 640+, but manual underwriting can approve 580–639 when the overall file is strong. Underwriters evaluate the full picture, not just a score.

Common compensating factors

- On-time housing or rent history for 12–24 months

- Stable employment and verifiable income with likelihood to continue 3+ years

- Lower debt-to-income ratios or cash reserves after closing

- Documented recovery from a temporary hardship (medical, job loss, divorce)

Expectation setting: manual underwrites mean tighter DTI caps, extra documentation, and possible letters of explanation.

Key Kentucky USDA loan benefits

Zero down payment

Finance 100% of the purchase price. Preserve cash for moving, upgrades, or an emergency fund.

Competitive interest rates

USDA’s guarantee helps lenders offer compelling rates, often better than comparable low-down-payment alternatives.

Flexible credit approach

Manual underwriting can bridge the gap for qualified borrowers at 580–639 with strong compensating factors.

Lower ongoing insurance cost than FHA

USDA uses a 1% upfront guarantee fee (financeable) and a modest annual fee, typically lower than FHA’s MIP for similar scenarios.

Manufactured home option (new homes meeting standards)

In eligible cases, new manufactured homes on permanent foundations may qualify, expanding affordable options in rural markets.

Eligibility: income, property location, occupancy

- Income: generally up to 115% of area median income; household income counted with allowable deductions

- Location: property must be in a USDA-eligible tract

- Occupancy: primary residence only; 1-unit homes (site-built or qualifying new manufactured)

- Credit/DTI: target total DTI ≤ 41% for manual underwrites unless strong compensating factors justify higher

Step-by-step: Kentucky USDA application timeline

- Pre-qualification and document setup (W-2s, pay stubs, bank statements, ID)

- Shop eligible areas and write offer with USDA financing contingency

- Full application, disclosures, and underwriting review

- USDA appraisal and any additional verifications

- Final approval, closing disclosure, and closing

Typical end-to-end: 30–45 days; manual underwrites can add several days. Proactive docs and clean credit explanations accelerate cycle time.

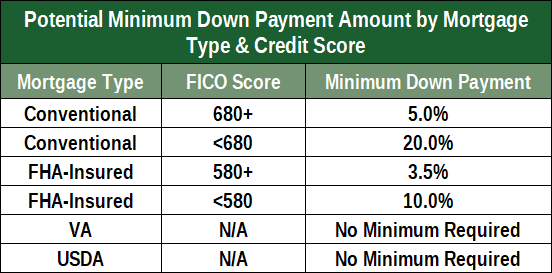

USDA vs FHA vs Conventional for Kentucky buyers at 580

| Feature | USDA | FHA | Conventional |

|---|---|---|---|

| Minimum score | 580 (manual underwrite) | 580 with 3.5% down; 500 with 10% down | Typically 620+ |

| Down payment | 0% | 3.5% at 580+ | 3–20%+ |

| Geography | Eligible rural/suburban tracts only | No location limits | No location limits |

| Income limits | Yes (household-based) | No | No |

| Insurance/fees | 1% upfront (financeable) + annual fee | 1.75% upfront + annual MIP | PMI if < 20% down; cancellable |

Kentucky coverage: eligible areas exist in all 120 counties

Many buyers are surprised how far USDA eligibility extends. Even fringe suburbs near major job centers can qualify. Verify specific addresses before you make an offer.

Frequently asked questions

Can I get approved with a 580 credit score?

Yes, via manual underwriting when your overall profile supports repayment. Expect extra documentation and tighter DTI caps.

What are the income limits?

County- and household-based, generally up to 115% of area median income with certain deductions. Verify totals before shopping.

How long does approval take?

Plan for 30–45 days; manual reviews may add several days. Clean, complete files move faster.

Are manufactured homes allowed?

New manufactured homes that meet HUD code and permanent foundation standards may qualify in eligible areas.

Do USDA loans have mortgage insurance?

USDA uses a guarantee fee model: 1% upfront (can be financed) and a modest annual fee that’s typically lower than FHA MIP.

Next step: pre-qualify for a Kentucky USDA loan

If 0% down with a competitive rate fits your plan—and your target area is USDA-eligible—let’s pressure-test your file today.