How to Qualify for a USDA Rural Housing Loan in Kentucky

Are you looking to buy a home in rural Kentucky with no down payment? A USDA rural housing loan could be your path to homeownership. This comprehensive guide covers everything you need to know about qualifying for USDA mortgage loans in Kentucky. It includes information on income limits, credit requirements, and the application process.

In this article, I will walk you through everything you need to know about qualifying for a USDA loan in Kentucky, the types of loans available, income limits, credit score requirements, and how to apply.

The Department of Agriculture offers these loans at interest rates below the average mortgage. Although offered through the USDA, this program is not directed at farmers. It is a low-income housing program designed to help non-urban consumers buy houses who otherwise might not qualify for a loan or afford a mortgage. As a result the requirements to qualify for a USDA loan tend to be different, and typically less stringent, than for a traditional bank loan.

Types of USDA Loans in Kentucky.

There are three types of USDA housing loans available in Kentucky:

Kentucky USDA Direct Loan

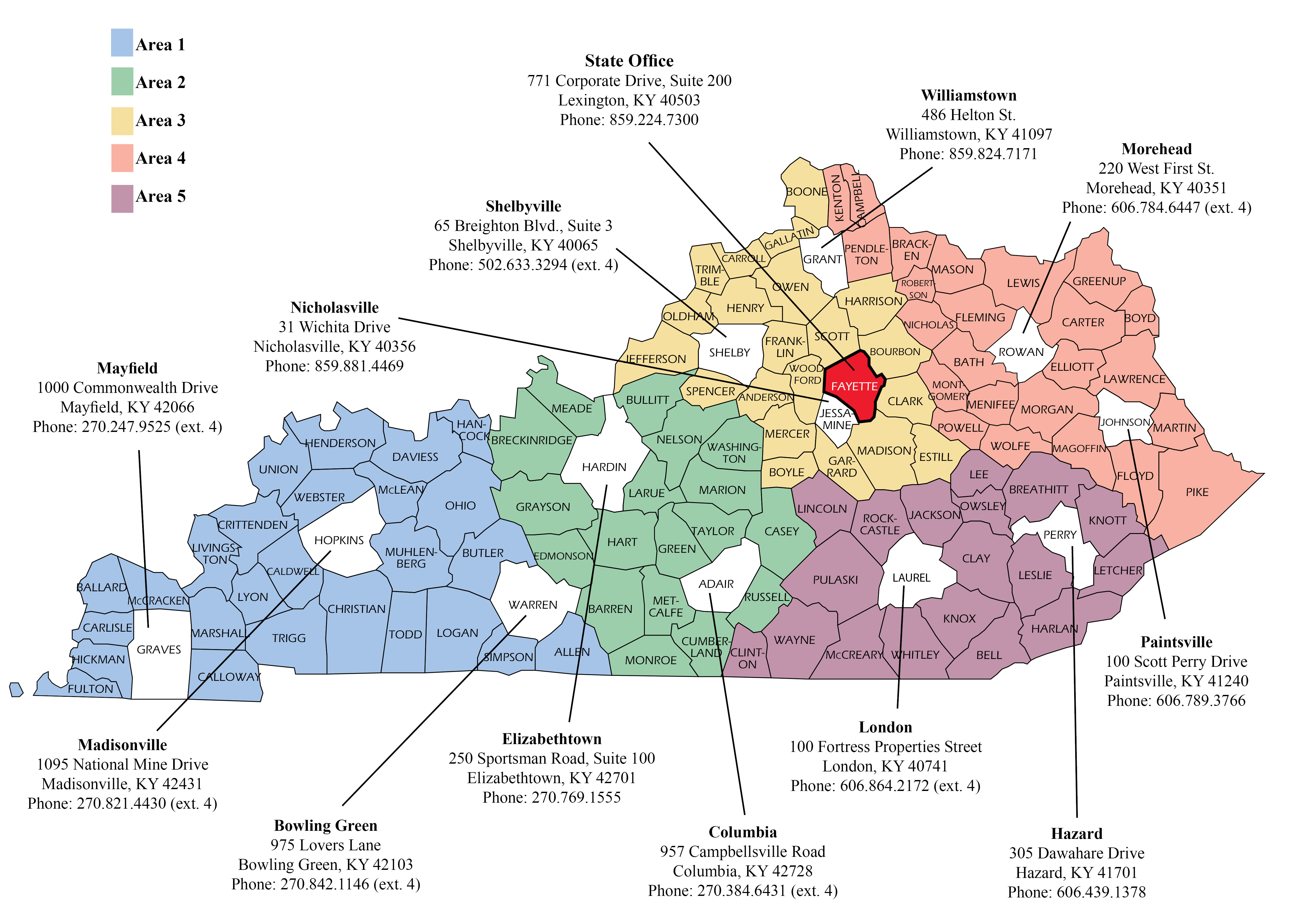

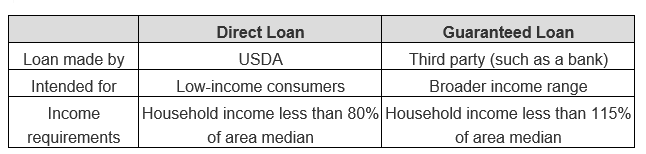

These loans are issued directly by the Department of Agriculture and not by a lender. You will deal directly with the local USDA office that represents your location. They're are several USDA offices in Kentucky that service different parts for the Direct USDA loan. This makes them similar to the housing loans offered by the Department of Defense and Veterans Affairs. While direct loans typically offer the best interest rates, sometimes below 1% depending on the applicant and area, they are also highly income-restricted and take months to close usually. This program is geared toward low- and very low-income households. You cannot get a direct loan without demonstrating that you can't afford any other available terms.

This is sometimes otherwise known as a Section 502 Loan, referring to the code section which created the program.

These loans are issued by banks, mortgage companies, mortgage brokers, credit unions and State Housing Agencies by private lenders but backed by the Department of Agriculture. (This means that the USDA will pay the lender back in the event that you default on the mortgage.) As a result, lenders will issue mortgages to people with lower credit scores than they would otherwise and will do so on more favorable terms. Typically USDA will insure the lender up to 90% of the homes loss so lenders can make the loan with very good protections. For example, if a home was originated a $100k loan amount, and was foreclosed upon for non-payment, then the lender will get up to $90k protection on the losses attributed to the losses incurred by the USDA lender.

Like a direct loan, the guaranteed loan program has income requirements. It is less stringent than direct lending, however. This program targets low income households. This is by far the most popular USDA loan made in Kentucky with over 4000 Kentucky Guaranteed Mortgage loans made annually in Kentucky.

In both cases the government's involvement means that borrowers pay little, if anything, in the form of a down payment.

Kentucky Housing Grants

In addition to its mortgage program the Department of Agriculture also issues loans and grants to rural residents for home upgrades and repair. As with the direct lending program, the USDA provides these grants to low- and very low-income households. The homeowner must use them to "repair, improve or modernize" the home or "remove health and safety hazards" and must occupy the house; in other words, you cannot get a USDA grant to improve a rental property.

The USDA provides a fact sheet explaining in greater detail what a repair loan is and how to get one.

• A pro rata share of real estate taxes that is due and payable on the property at the time of loan closing. Funds can be allowed for the establishment of escrow accounts for real estate taxes and/or hazard and flood insurance premiums.

• Essential household equipment such as wall-to-wall carpeting, ovens, ranges, refrigerators, washers, dryers, heating and cooling equipment as long as the equipment is conveyed with the dwelling.

Homeowners can check with the agency to find a full list of legitimate expenses, which can include property improvements as well as certain utilities and appliances.

Who Can Get a USDA Loan in Kentucky?

Applicants for a Kentucky Rural Housing USDA loan must meet several criteria.

• You must fall within the program's income limits, typically 115% of the median income for your region or less. The direct loan program requires a considerably lower income threshold than the guaranteed loan program does. As with all federal programs, income thresholds vary by community, household size and household composition.

A good first step before applying is to enter your personal information to see if you qualify for a USDA loan's income limits. here➡️ http://kentuckyruralhousingusdaloan.blogspot.com/p/guaranteed-housing-income-limits.html

• You must not use the loan for a commercial purpose or farming income from crops, livestock, and other income producing uses. The borrower has to personally occupy the home as permanent resident with no rental intentions for the home.

• You must be a U.S. citizen, national or qualified alien and must be legally able to take on debt

• You must purchase the home in a qualifying rural area. This program does not apply to cities, and the federal government runs no similar program to subsidize urban home ownership. You can search the USDA's map to find qualifying areas. here⬇️ http://kentuckyruralhousingusdaloan.blogspot.com/2018/02/usda-eligibility-map-usda-home-loan.html

• You must demonstrate the ability to pay this mortgage. While the criteria for a USDA loan is considerably lighter than with a bank, the agency still requires certain financial metrics. The mortgage payments plus the monthly payments on the credit report cannot exceed 45% of the borrower's gross monthly income.

• You must show your credit score. For a guaranteed loan most banks will require a credit score of at least 620 middle credit score from fico. , since this is the cutoff for the USDA's automatic approval underwriting process called GUS, anything below 640 will get referred to a person at USDA for a manual underwriter. However, this is not a minimum requirement and some banks may choose to proceed anyway.

The direct loan program also requires a score of at least 640 for automatic approval. Again, if you have a lower score or no credit history you may still qualify depending on specific circumstances and if you can show a history of on-time bill payment through paperwork such as rent and utilities.

USDA Direct Loan Specific Requirements

In addition to the above, the direct loan program adds the following requirements.

• You must not currently have "decent, safe and sanitary housing."

• You must have been unable to find a loan from other sources on terms that you could reasonably meet.

• You must buy a home that is 2,000 square feet or less with a market value no greater than the area's loan limit

Email - kentuckyloan@gmail.com

Email - kentuckyloan@gmail.com  Call/Text - 502-905-3708

Call/Text - 502-905-3708Joel Lobb

Mortgage Loan Officer - Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

The USDA Rural Housing Loan Program, also known as an RHS loan, provides an affordable path to homeownership with zero down payment. This government-backed mortgage program is ideal for low-to-moderate-income families in Kentucky who want to purchase a primary residence in eligible rural areas.

In this guide, we’ll walk you through everything you need to know about qualifying for a USDA loan in Kentucky, the types of loans available, income limits, credit score requirements, and how to apply.