10 Tips for Mortgage Loan Applicants Not to After Pre-Approval for a KY Mortgage

1. Don’t change jobs or become self-employed.

2. Don’t buy a car, truck, van, boat or motorhome unless you plan to live in it.

3. Don’t use your credit cards or let your payments fall behind.

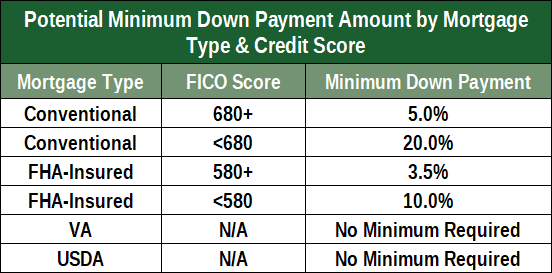

4. Don’t spend the money you have saved for your down payment.

5. Don’t buy furniture before you buy your house.

6. Don’t originate any new inquiries on your credit report.

7. Don’t make any LARGE or CASH deposits into your bank account.

8. Don’t change bank accounts.

9. Don’t co-sign for anyone.

10. Don’t purchase anything until after the closing.

Kentucky Mortgage Pre-Approval Checklist of Items Needed for Approval Letter

- Bank Statements - Last 2 Months – All bank statements for all accounts from the last 2 months. Include all numbered pages of all bank statements!

- Driver's License – Legible state-issued driver's license

- Evidence of Insurance – For all properties owned

- Federal Tax Returns - Last 2 Years – Last 2 years of federal tax returns to prove income, include all schedules

- HOA statement (if applicable) – Most current statement

- Loan Application (1003) – Please complete all fields

- Mortgage Statement(s) – Most recent for all properties owned

- Pay Stubs - Received in Last 30 Days – Last 30 days of pay stubs to prove income

- Social Security Card – Legible social security card to prove social security number

- W-2s - Last 2 Years – Last 2 years of W-2s to prove income

Mortgage Loan Officer

email: kentuckyloan@gmail.com