USDA offers three specific refinance products to afford existing guaranteed and direct borrowers the opportunity to benefit from a lower interest rate and increase their ability to maintain successful homeownership.

Options available:

Non-Streamlined

Streamlined

Streamlined-Assist

The last option is available to existing Rural Development Direct and Guaranteed Loan borrowers.

The SFHGLP offers three specific refinance products to afford existing guaranteed and direct borrowers the opportunity to benefit from a lower interest rate and increase their ability to maintain successful homeownership

. • A refinance loan is not an option for non-performing loans. In these cases, loss mitigation options should be explored.

• We will discuss the differences between the Non-Streamlined, Streamlined, and Streamlined-Assist options in the next slides.

The most popular and most streamlined refinance option is the streamlined-assist option.

• As you can see, with this option, a new appraisal is not required unless the borrower is a direct loan borrower that received payment subsidy.

• However, only deceased borrowers can be removed with this option.

• So in cases where a non-deceased borrower is being removed, the remaining borrower may opt for the non-streamlined or streamlined option.

• Another key difference that may help determine which option is best is credit history.

• The streamlined-assist option only requires that the loan be paid as agreed for 12 months prior to loan application whereas the other two options require a full credit review and qualification per HB-1-3555, Chapter 10 guidelines.

• All options allow the borrower to refinance the principal and interest balance, reasonable and customary closing costs, and the upfront guarantee fee

. • If subsidy recapture is due and the borrower wants to include it in the new loan, they would choose the non-streamlined option. • Subsidy recapture with the other two must be paid with other funds or subordinated to the new guaranteed loan.

The streamlined-assist option does not require a ratio calculation, the other 2 options

do require a calculation and waiver if required.

• The GUS may be utilized for the non-streamlined and streamlined options but not the

streamlined assist.

• All options require that the existing loan be closed at least 12 months prior to the

Agency’s receipt of a request for Conditional Commitment.

• No tangible benefit is required for the non-streamlined and streamlined options, but the

borrower’s PITI payment must reduce by at least $50 with the streamlined-assist option.

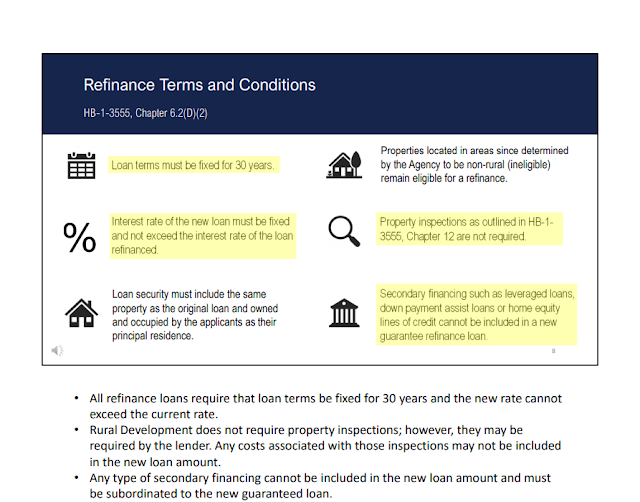

All refinance loans require that loan terms be fixed for 30 years and the new rate cannot

exceed the current rate.

• Rural Development does not require property inspections; however, they may be

required by the lender. Any costs associated with those inspections may not be included

in the new loan amount.

• Any type of secondary financing cannot be included in the new loan amount and must

be subordinated to the new guaranteed loan.